Importance of Reconciliation in Accounting 2023

Reconciliation is process of matching bank balances between the bank statement issued by the Banking Institution and the books on a predetermined date (month/year).

Download Our Free Brochure →To maintain accuracy bank statement balances and the business’s books should match. Any differences should be treated or excluded (except for Checks received but not deposited and Checks paid but not presented).

Benefits of reconciliation

- Reconciliation of an account in regular periods keeps the books accurate and error free.

- Knowing the status of the Checks received but not deposited and Checks paid but not presented at any time will help to keep a track of all stale checks.

- Cross checking increases authenticity and reliability.

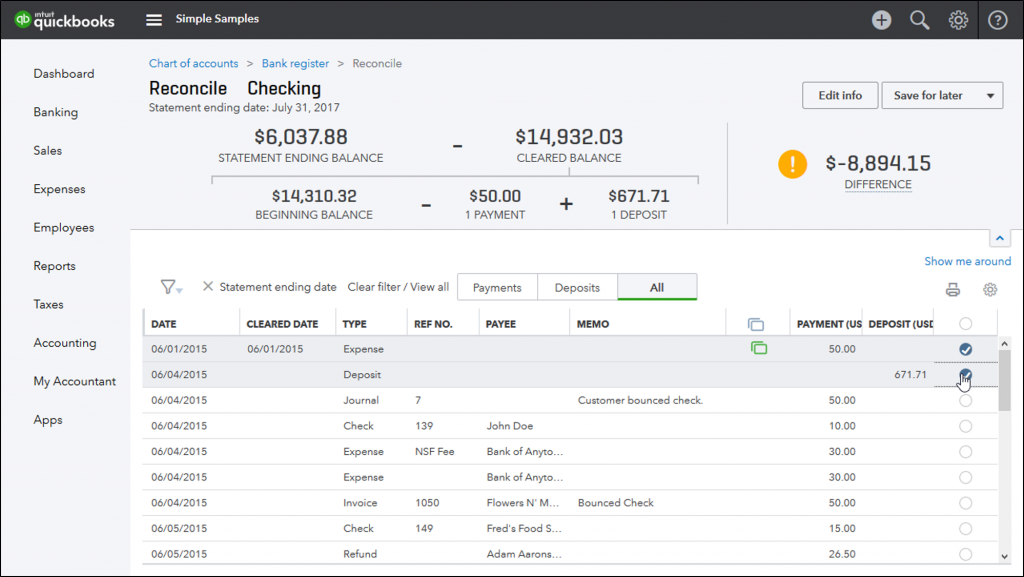

Reconciliation in QuickBooks

Bookkeeping of a bank account in QuickBooks for a given period, produces an automatic list of transactions for reconciliation in the Reconciliation tab. This means that the transactions from the banking feed will be marked as reconciled and the transactions which are manually recorded will be available for the user to examine. Information, such as Beginning & Ending balance, payments and deposits, and any differences will be displayed on the reconciliation screen. With reconciliation, any account becomes simple to work with when compared to traditional practice.